The 8th Pay Commission fitment factor has become one of the most searched and discussed topics among central government employees in India. Every time a new pay commission cycle comes closer, questions around salary revision, revised pay matrix, and expected increases begin trending across search platforms. The fitment factor plays a crucial role in determining how much an employee’s basic salary changes under a new commission.

For millions of govt employees, understanding the logic behind the 8th Pay Commission fitment factor helps in decoding salary expectations, DA integration, and overall income structure. This article explains the meaning, working formula, importance, and practical salary impact in simple language.

What Is the 8th Pay Commission Fitment Factor?

The 8th Pay Commission fitment factor is a numerical multiplier used to revise the basic salary of government employees when a new pay commission is implemented. It acts as a bridge between the old pay structure and the revised one.

In simple terms, the fitment factor determines how much your existing basic pay will be multiplied to arrive at the new basic pay under the updated pay matrix.

For example, if an employee has a basic pay of ₹20,000 and the fitment factor is 3.00, the revised basic becomes ₹60,000.

This mechanism ensures uniform salary revision across all levels while factoring in inflation, Dearness Allowance (DA), and cost-of-living adjustments.

Why the Fitment Factor Matters So Much

The reason the 8th Pay Commission fitment factor attracts so much attention is because it directly impacts take-home salary, allowances, and long-term financial planning.

Here’s why it matters to govt employees:

• Determines the revised basic salary

• Influences DA calculation after implementation

• Affects HRA, TA, and other allowances

• Impacts pension calculations

• Shapes overall pay matrix structure

• Influences promotion-level salary slabs

Even a small change in the fitment factor can create a significant difference in monthly income.

Understanding Salary Calculation Using Fitment Factor

To understand salary calculation, it’s important to know how previous commissions applied the formula. The fitment factor is usually applied to the basic pay plus applicable DA at a specific cut-off date.

A simplified formula looks like this:

Revised Basic Pay = Old Basic Pay × Fitment Factor

However, in practice, the government also considers merged DA and rounds off figures into structured levels under the pay matrix.

This structured approach avoids random salaries and ensures consistency across departments.

How Dearness Allowance (DA) Connects to the Fitment Factor

DA plays a major role in deciding the final number used as the fitment factor. Typically, when a new pay commission is implemented, DA up to a certain percentage is merged into the basic pay.

This merged amount forms the base for calculating the new salary.

That’s why discussions around the 8th Pay Commission fitment factor often include conversations about:

• Current DA percentage

• Inflation trends

• Cost of living index

• Consumer price movement

Higher DA accumulation usually supports a higher multiplier.

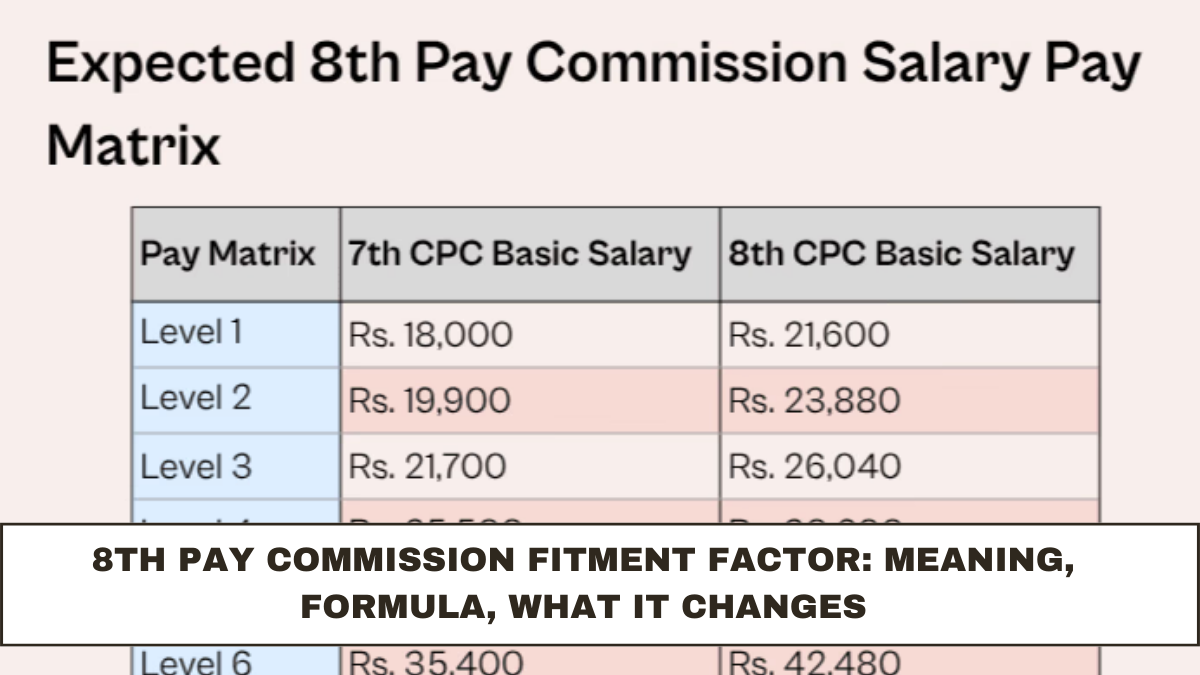

Role of the Pay Matrix in Salary Revision

The pay matrix is the backbone of modern salary structures. Under the 7th Pay Commission, pay bands were replaced with a level-based matrix.

The same approach is expected to continue when the 8th Pay Commission fitment factor is applied.

Each level in the pay matrix:

• Has fixed vertical salary progression

• Allows annual increments

• Ensures clarity in promotion-based movement

• Simplifies salary calculation

Once the fitment factor is finalized, new pay levels are generated automatically using multiplication logic.

Why Govt Employees Closely Track Fitment Factor Updates

Among all pay commission components, the 8th Pay Commission fitment factor receives the most attention because it directly defines income growth.

Government employees monitor it closely due to:

• Rising inflation pressure

• Increased household expenses

• Education and healthcare costs

• Housing and EMI burdens

• Long-term retirement planning

Even a slight upward adjustment can significantly improve financial security over time.

Difference Between Fitment Factor and DA Increase

Many people confuse DA hikes with fitment factor revision. While both affect income, they work differently.

DA:

• Revised periodically

• Linked to inflation

• Added to basic pay temporarily

• Can go up or down

Fitment Factor:

• Applied once during pay commission

• Creates a new base salary

• Permanent structural change

• Impacts entire pay matrix

Understanding this difference helps govt employees plan expectations realistically.

How Salary Levels Change After Applying Fitment Factor

Once the 8th Pay Commission fitment factor is applied, salaries are restructured across all levels. Entry-level, mid-level, and senior positions each receive proportional upgrades.

This results in:

• Higher starting salaries for new recruits

• Better increments across levels

• Improved promotion-linked pay jumps

• Stronger pension base for retirees

The pay matrix ensures fairness while maintaining hierarchy.

Why the Fitment Factor Is Politically and Economically Important

Salary revisions affect government finances on a massive scale. That’s why the 8th Pay Commission fitment factor is carefully studied by policymakers.

It impacts:

• Government expenditure

• Fiscal planning

• Employee morale

• Public sector attractiveness

• Long-term pension liability

Balancing employee welfare and economic sustainability becomes a key challenge in finalizing the number.

How Employees Can Understand Their Expected Salary Impact

While the final number will be officially notified later, employees can still understand the mechanism by:

• Tracking current basic pay

• Knowing present DA percentage

• Understanding pay matrix level

• Applying hypothetical multipliers

• Comparing previous commission patterns

This gives a reasonable idea of how salary calculation works under a new commission.

Why This Topic Is Trending Right Now

Search interest around the 8th Pay Commission fitment factor is rising because employees want clarity early. Discussions across social platforms, forums, and employee groups show strong curiosity around:

• Salary restructuring

• DA merging logic

• Future pay matrix

• Pension impact

• Income stability

This makes it one of the most trending finance and government job topics in India.

Long-Term Impact on Government Employees

Beyond immediate salary hikes, the 8th Pay Commission fitment factor influences long-term financial planning in several ways:

• Higher retirement benefits

• Improved gratuity base

• Better loan eligibility

• Increased savings capacity

• Enhanced lifestyle stability

For many govt employees, it becomes a turning point in career earnings.

Summary: Why the Fitment Factor Matters Most

The 8th Pay Commission fitment factor is more than just a number. It defines how salaries evolve, how DA is absorbed, and how the entire pay matrix reshapes income levels across departments.

Understanding its meaning, formula, and impact helps employees stay informed, financially prepared, and confident about future revisions.

As discussions around salary restructuring continue, clarity around this concept remains essential for every government employee in India.

FAQs

What is the 8th Pay Commission fitment factor?

The 8th Pay Commission fitment factor is a multiplier used to revise basic salaries by converting old pay into a new pay structure.

How does the fitment factor affect salary calculation?

It multiplies the existing basic pay to determine the revised basic salary under the new pay matrix.

Is DA included in the fitment factor?

Yes, DA up to a certain level is usually merged while calculating the fitment factor.

Why do government employees track the fitment factor closely?

Because it directly affects salary, allowances, pension, and long-term financial benefits.

Does the fitment factor apply to all employees?

Yes, it applies across levels, with structured pay matrix slabs ensuring uniform revision.