The PAN Aadhaar inoperative 2026 rule isn’t a distant compliance reminder—it’s an operational shutdown that hits before you realize what’s wrong. People don’t feel the impact at the moment the deadline passes; they feel it when everyday financial actions suddenly fail. A bank update won’t go through. A tax task stalls. A verification step loops endlessly.

This isn’t about fines first. It’s about friction first. And the friction compounds quickly.

What “PAN Inoperative” Actually Means

“Inoperative” doesn’t mean cancelled—but it does mean blocked for use until Aadhaar linkage is completed.

When PAN turns inoperative:

-

PAN is invalid for financial transactions

-

Banks and platforms reject PAN-based verification

-

Tax workflows break mid-process

The PAN Aadhaar inoperative 2026 status functions like a soft freeze that spreads across systems.

What Breaks First When PAN Goes Inoperative

The earliest failures are the most common ones—because they’re routine.

Expect issues with:

-

Bank KYC updates

-

Mutual fund or demat actions

-

Salary onboarding or verification

-

Large-value transactions requiring PAN

These failures don’t always explain themselves. Systems simply “can’t verify PAN.”

Tax filing is where most people discover the problem.

Common tax filing issues include:

-

Inability to file returns

-

Failed e-verification

-

Refund processing delays

-

Notice replies getting blocked

Even if income details are correct, an inoperative PAN halts submission or processing.

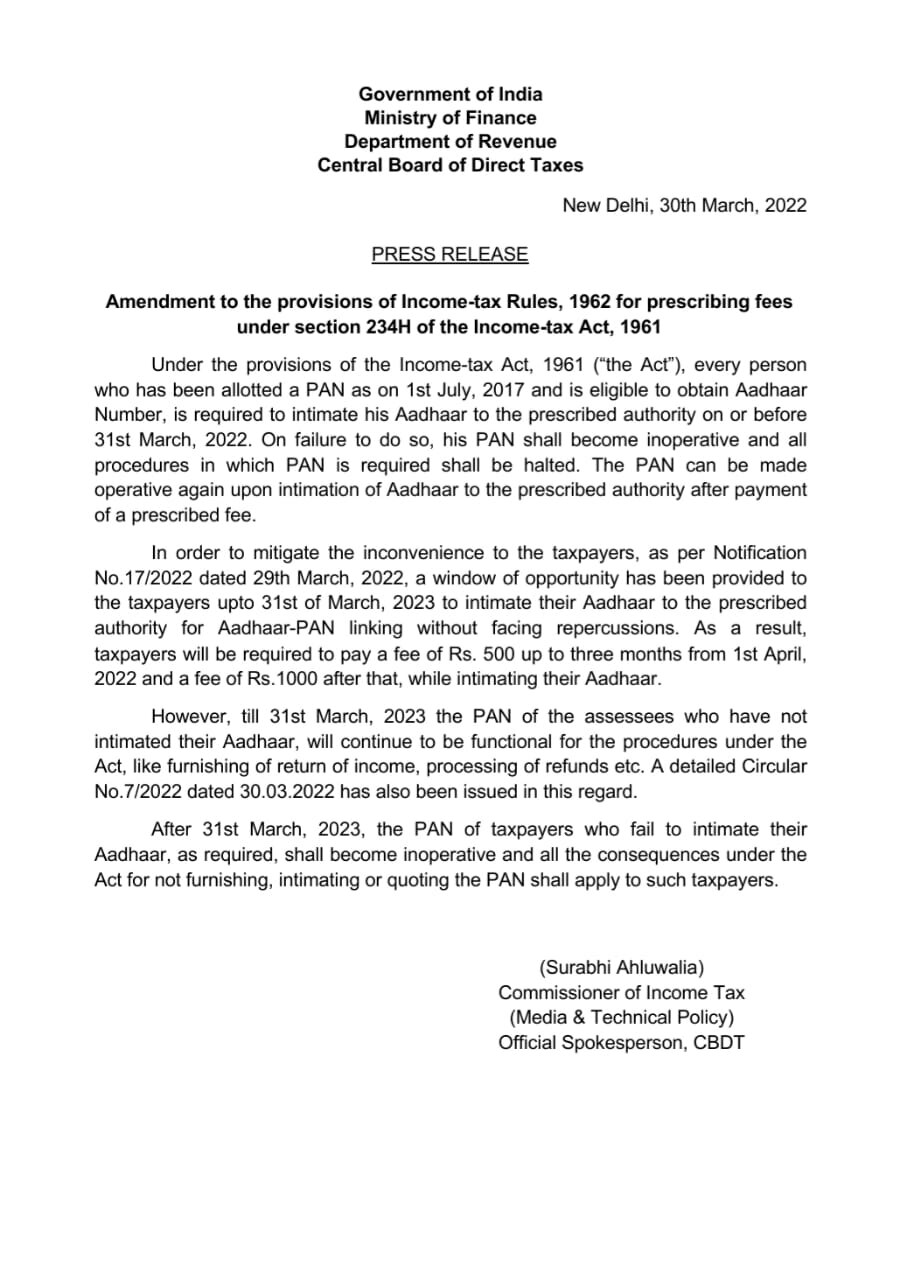

The Linking Deadline and Penalty Reality

Missing the linking deadline doesn’t just flip a switch—it adds cost and delay.

What usually applies:

-

Mandatory late-linking fee

-

Waiting period for reactivation

-

Temporary transaction restrictions

Paying the penalty is often unavoidable once PAN becomes inoperative. Avoiding it requires timely action.

Why Mismatches Cause Most Failures

Most PAN–Aadhaar links fail for small, fixable reasons.

Typical mismatch causes:

-

Name spelling differences

-

Date of birth format issues

-

Initials vs full names

-

Legacy PAN data errors

The PAN Aadhaar inoperative 2026 risk rises when these aren’t corrected early.

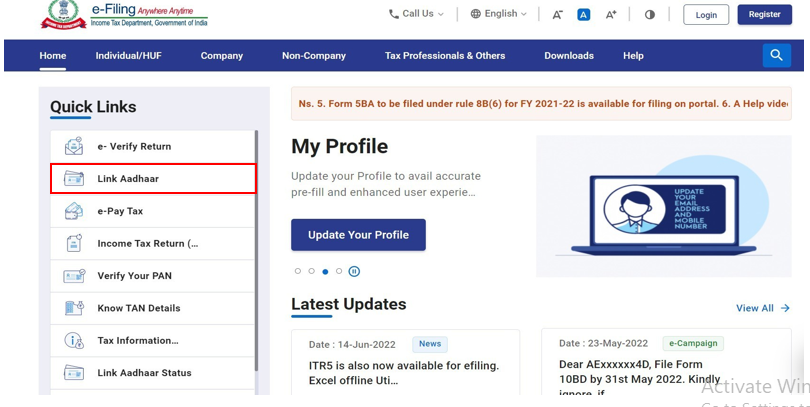

Fastest Way to Reactivate an Inoperative PAN

Reactivation is possible—but it’s not instant everywhere.

Practical steps:

-

Correct mismatches on the official portal

-

Complete Aadhaar linking with fee payment

-

Wait for status update confirmation

-

Reattempt blocked transactions after activation

Expect some systems (banks, platforms) to take extra time to sync.

Who Is Most at Risk of Sudden Disruption

Not everyone feels the impact equally.

High-risk groups:

-

Freelancers and consultants

-

Active investors

-

People changing jobs

-

Anyone expecting refunds or verifications

If PAN is part of your monthly workflow, PAN Aadhaar inoperative 2026 will surface fast.

Why “I’ll Do It Later” Is the Costliest Choice

Delay multiplies pain:

-

More platforms reject PAN

-

Manual follow-ups increase

-

Deadlines stack up

-

Penalty becomes unavoidable

This is one compliance task where postponement creates cascading problems.

What PAN Inoperative Does NOT Mean

Clear the myths:

-

PAN is not cancelled permanently

-

Your history isn’t erased

-

You don’t lose past filings

But access is restricted until compliance is restored.

How to Check Your PAN Status Safely

Before assuming anything, verify status through official channels only.

Avoid:

-

Third-party status checkers

-

Agents offering “instant fixes”

-

Unverified links or messages

Status clarity prevents unnecessary panic.

Conclusion

The PAN Aadhaar inoperative 2026 rule doesn’t punish with headlines—it punishes with everyday breakdowns. The first failures hit banking and tax workflows, not penalty notices. Fixing it later costs more time, more money, and more stress than doing it now.

Link early, verify status, and keep your financial systems moving.

FAQs

What happens if my PAN becomes inoperative?

Financial and tax-related actions fail until Aadhaar linkage is completed.

Can an inoperative PAN be reactivated?

Yes, by completing Aadhaar linking and paying the applicable fee.

Do tax refunds stop if PAN is inoperative?

Refunds can be delayed or blocked until PAN becomes operative again.

Why do most PAN–Aadhaar links fail?

Name or date-of-birth mismatches are the most common reasons.

Is the penalty avoidable?

Only if Aadhaar is linked before the deadline.